REGISTER NOW

Scan the QR Code to Register

Scan the QR Code to Register

Delegates

Speakers

International Speakers

Government Speakers

Total Countries

Awardees

Theme: Growing Illicit Trade: Destabilising Economic Welfare

Illicit trade remains one of the most pressing global threats undermining economic progress, rule of law, and consumer safety. It is an unfair trade practice that erodes legitimate business, distorts markets, weakens global supply chains, depletes natural resources, and endangers public security.

As economies strive for inclusive and sustainable development, the growing menace of counterfeiting and smuggling continues to destabilize efforts by diverting resources and threatening livelihoods. Consumers, often unaware of the dangers, become the ultimate victims of substandard and unsafe products.

A weak enforcement regime, gaps in legal infrastructure, and low levels of public awareness further fuel the spread of illicit trade. Addressing these challenges requires a robust policy framework, stronger international cooperation, and widespread consumer sensitization.

MASCRADE 2025 calls for coordinated action and strategic interventions to counter these emerging threats. Promoting genuine products, empowering consumers with knowledge, and reinforcing legal deterrence are critical to safeguarding economic welfare and securing the development gains of nations.

Socio-economic impact of illicit trade on both global and Indian economies and the way forward

Exploring how illicit trade undermines tax equity, shifting the burden to compliant taxpayers and eroding public trust in the taxation system

Establishing and enforcing international norms to effectively prevent, detect, and combat illicit trade practices.

Evaluating the economic consequences of illicit trade including losses in government revenue, job loss, threat to public health and safety and broader economic distortions

Identifying regulatory gaps and proposing actionable policy reforms to enhance enforcement, governance, and economic resilience

Use of advanced technologies such as AI, machine learning, and blockchain to counteract emerging patterns of illicit trade.

Leveraging digital tools to support revenue protection, reduce tax evasion linked to illicit trade, and encourage fair, widespread tax compliance.

Strengthen cybersecurity measures to safeguard institutions from the growing risk of cyber threats and digital exploitation in illicit trade.

Foster collaborative research, monitoring and development to create innovative tools and technologies for tracking products on e-commerce platforms.

Adopt transparency solutions across supply chains to track the flow of goods, ensuring traceability and identifying vulnerable points prone to illicit activities.

Promoting strategic alliances across nations to drive unified investigations and coordinated crackdowns on illicit trade

Integrating proven international best practices that champion transparency, integrity, and effective policy frameworks to curb illegal trade networks

Advancing cross-border cooperation via international treaties, shared protocols, and mutual legal support systems to dismantle illicit operations

Fostering a shared global commitment by encouraging tax-compliant societies through transparent and collaborative governance

Navigating the complexities of international collaboration by addressing barriers and harnessing opportunities for seamless data and intelligence sharing

Bridging policy, enforcement, and strategic gaps to build a unified national approach against illicit trade

Discussing how a larger tax base is more effective vis-a-vis high rates of taxes in achieving sustainable revenue

Exploring the relationship between tax rates and levels of evasion and compliance

Leveraging think tank insights and empirical evidence to inform targeted anti-illicit trade interventions

Examining the role of public-private partnerships in strengthening enforcement capacity and preventive strategies

Examining the scale, complexity, and economic impact of organized crime driven by illicit trade activities.

Enhancing the use of data and insights to drive coordinated investigations, enforcement, and disruption strategies.

Role of enforcement agencies in detecting and investigating illicit trade activities.

Need for cross-border coordination to combat smuggling and mitigating vulnerabilities in supply chains that are susceptible to exploitation by illicit trade networks.

Discussing how improved tax compliance can foster nation-building by driving a positive shift in core value system.

Promoting synergistic collaboration between government bodies and private enterprises to tackle counterfeiting and smuggling more effectively.

Highlighting real-world examples and key takeaways from initiatives that have successfully curbed illicit trade.

Emphasizing the role of tax equity in fostering a level playing field for businesses and supporting economic growth.

Exploring cutting-edge technologies and strategic frameworks for identifying and neutralizing threats in illegal markets.

Evaluating the challenges and opportunities of uniting diverse industries and sectors in the collective fight against illicit trade.

![]()

![]()

Concept Note MASCRADE 2025Download Pdf

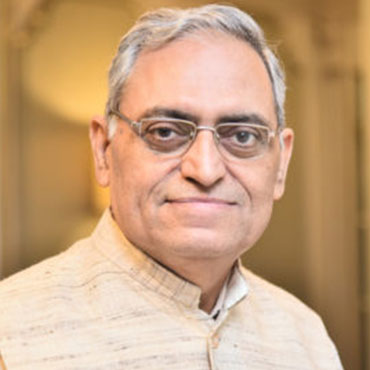

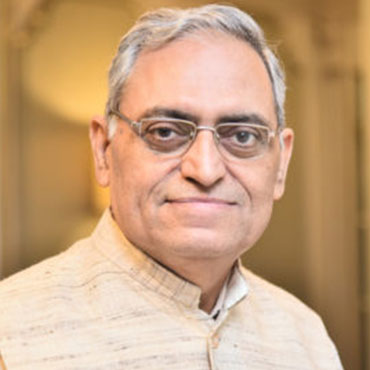

Kashifa Hasan

Joint Director, FICCI CASCADE