Tobacco Tax Gaps: Small Rise Shows Need for New Government Action

Official figures released today show that the level of tobacco smuggling in the UK in 2013/14 has risen slightly since last year. According to HM Revenue & Customs, in 2013/14 an estimated 10% of cigarettes consumed in the UK were illicit compared to 9% in 2012/13. The figures for hand rolled tobacco were 39% in 2013/14 compared to 36% in 2012/13 (all figures mid-range estimates).

The figures show the need for the Government to act on recommendations on tobacco smuggling from the National Audit Office and the House of Commons Public Accounts Committee. The PAC reported that “HMRC has not yet found the right balance in its enforcement action, which can range from prosecutions of organised criminal gangs to imposing fines or referring offenders to licensing authorities for those involved in local, small-scale operations”. The House of Commons Home Affairs Select Committee has also sharply criticised the Government and enforcement authorities for failing to prosecute any of the major tobacco firms in cases where they have over-supplied tobacco to particular countries with low tobacco taxes, knowing that it will be smuggled back into the UK.

Related Posts

The notorious industry: comparing foreign vs. local tobacco brands on the Arab street

One of the most prolific industries currently operating in the Middle East and...

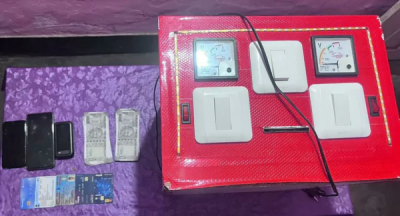

₹50,000 Fake Currency Seized In Guwahati, Two Arrested

GUWAHATI: In a recent crackdown on the illicit trade of Fake Indian Currency...

Unauthorised sellers via social media face Dh25,000 fine

People selling products on social networks could be fined Dh25,000 and have their...

Gold Worth 42 Lakhs Hidden In Man’s Rectum, Seized At Airport In Telangana

The accused passenger was intercepted by the Customs Air Intelligence unit of...